[ad_1]

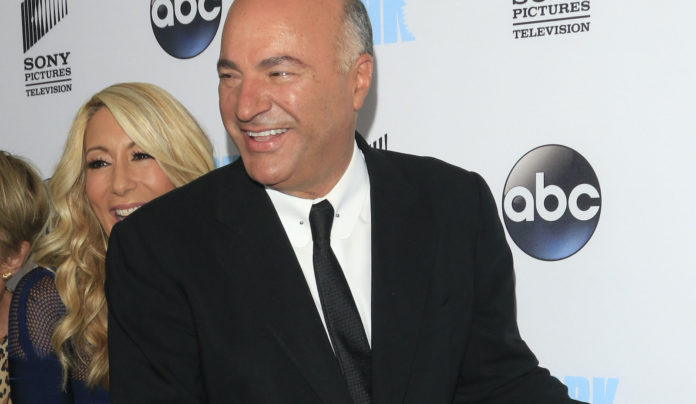

An exchange between businessman and co-host on NBC’s “Shark Tank” Kevin O’Leary and Morgan Creek Digital’s Anthony “Pomp” Pompliano over his bitcoin holdings turned sharp due to the nature of the Pomp’s holdings.

Speaking on CNBC, O’Leary challenged bitcoin’s role as a “safe haven” asset. Pompliano said over half of his net worth resides in the first cryptocurrency to which O’Leary called out the foolishness of such a holding scheme in his opinion.

“In any one stock, never more than 5%, in any one sector, never more than 20%,” O’Leary said. “I teach this stuff! You never go beyond concentrations of that nature! Fifty percent! Shame on you! That’s nuts!”

Responding to bitcoin’s role as a safe haven, Pompliano said the asset is negatively correlated with every other major asset class.

“[Morgan Creek Digital] has been banging the drum for over a year now saying that this is a non-correlated asymmetric asset. If you look at times of global instability like in May, where we are lobbing tariff threats and the trade wars are going on, bitcoin is up 55%. Its got a negative correlation, -0.9 to S&P negative -0.8 to gold.”

O’Leary’s main point concerned alternative cryptocurrencies.

“If this is really such a great idea, why is there really only one Vegas game working?” he asked.

Two years ago, O’Leary explained, he purchased $100 of various cryptocurrencies like bitcoin, bitcoin cash, XRP, ethereum, and stellar lumens. His holdings are down about 70%.

Pompliano responded by saying no exposure to the asset class was irresponsible for financial institutions.

CNBC’s segment on bitcoin as a safe haven was an extension of the currency discussion occurring around China. Yesterday, the United States labelled China a currency manipulator.

The U.S. announcement fell on the heels of reports between Chinese capital fleeing into alternative investments like cryptocurrencies. A recent report by CoinDesk said between $10 and $30 million Tether daily trade volume is conducted in Moscow from mostly Chinese accounts.

Image via Kathy Hutchins / Shutterstock.

[ad_2]

Source link